2025 UK Property Market Outlook: Sustained Growth Despite Economic Headwinds

Despite an increase in available rental properties, tenants may allocate as much as 40% of their income towards rent.

Despite potential challenges such as rising stamp duty rates, the trajectory of the UK property market remains upward, fuelled by increasing wages and declining interest rates. This trend underscores the resilience of real estate values in the face of economic fluctuations.

The continuous ascent of property values appears unstoppable, even in the face of impending increases in stamp duty.

The UK housing market has navigated significant turbulence following the economic disturbances triggered by Liz Truss’s mini budget in September 2022, which sharply increased borrowing costs, impacting households across the region.

Despite ongoing challenges with heightened mortgage and rent expenses, the housing sector has demonstrated remarkable resilience. Contrary to expectations of stagnant or declining prices, Nationwide Building Society reports that the market is stronger than anticipated. After a decline of 1.4% in 2023, average house prices are on track to close 2024 with over a 3% increase.

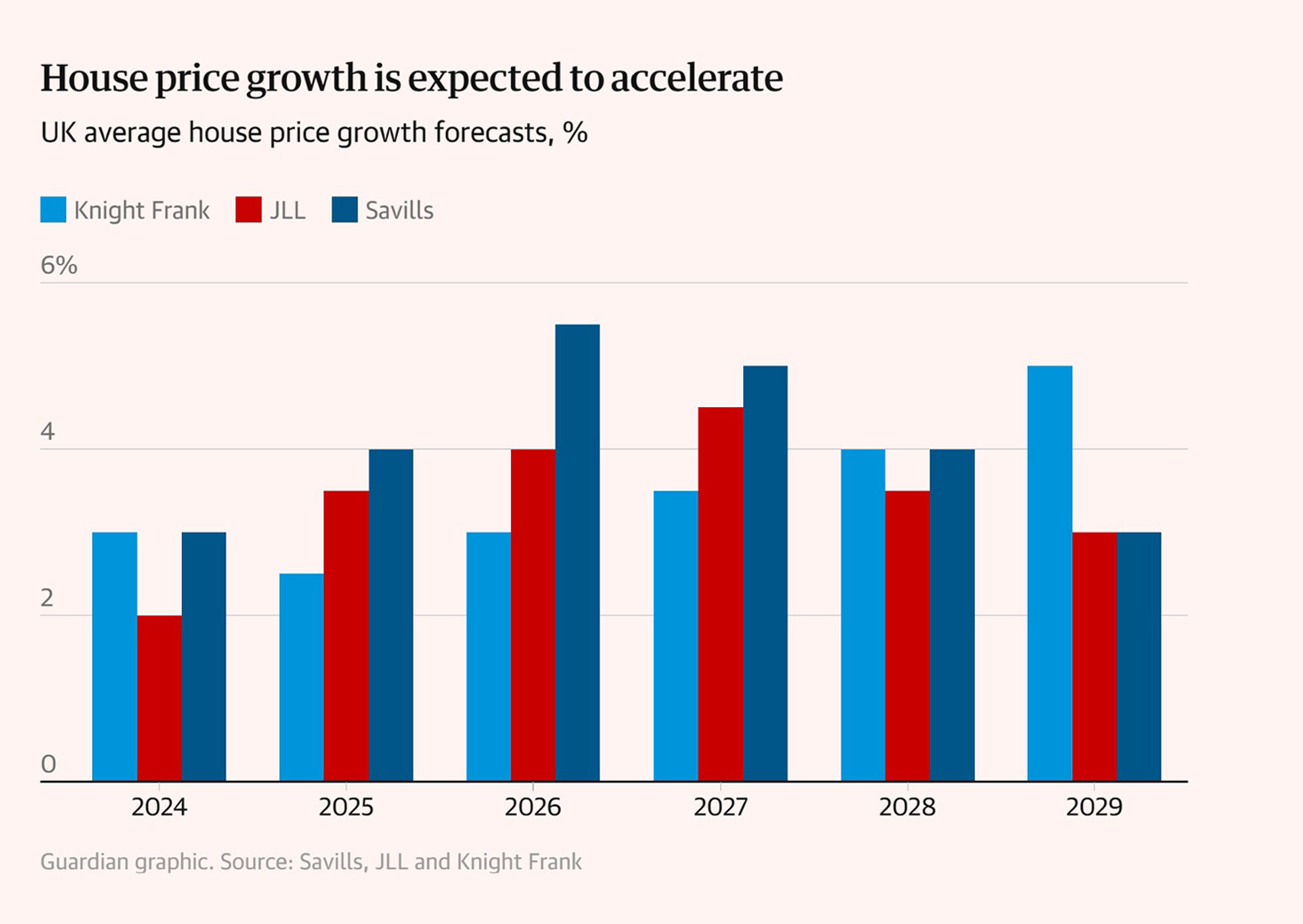

As we look to 2025, the forecast suggests a continuation or slight increase in house price growth, potentially accelerating to around 5.5% by 2026. Meanwhile, the spike in rental prices experienced recently is expected to stabilize, returning to more traditional growth rates, as projected by lenders and real estate professionals.

The for-sale housing market is poised for enhancement as interest rates decline, although at a moderated pace due to persistent inflation. This backdrop, combined with the potential for incomes to increase at a rate surpassing that of house prices, sets a favorable stage for market dynamics.

Currently, the average price of a UK home approaches £300,000, as reported by Halifax, posing affordability challenges, particularly for first-time buyers who have been adversely affected by historical highs in rental rate growth.

Projections for 2025, sourced from esteemed analysts including Nationwide, Halifax, Jones Lang LaSalle, Savills, Knight Frank, Chestertons, Rightmove, Hometrack, and Capital Economics, suggest a price growth corridor between 2% to 4%. These forecasts reflect a cautiously optimistic outlook for the UK residential market amidst evolving economic conditions.

The UK housing market has demonstrated resilience, buoyed by robust wage growth, which stood at 5.2% in October, and marginally reduced mortgage rates. The uptick in approved mortgages, surpassing pre-pandemic levels as the year closed, further underscores this strength.

Following two interest rate reductions by the Bank of England in August and November, bringing the rate down to 4.75%, market dynamics were influenced by Rachel Reeves’s autumn budget. The budget’s £40 billion in tax increases has led economists and traders to temper their expectations for future rate cuts, anticipating a slight rise in inflation, which, along with persistent services inflation at 5%, restricts the central bank’s ability to lower borrowing costs further.

Financial markets are currently pricing in two to three additional rate cuts in 2025, potentially reducing the Bank rate to as low as 4% by year-end. According to Robert Gardner, Nationwide’s chief economist, the housing market is expected to maintain its robustness in this environment, though significant growth may be tempered by existing affordability constraints, which are projected to ease gradually.

Gardner noted the potential benefits of lower interest rates and income growth outpacing house price increases, though he cautioned that these factors would require time to significantly impact the market.

Despite recent upticks, mortgage rates have seen some reductions in fixed deals, as highlighted by David Hollingworth, associate director at L&C Mortgages. Current rates stand at 5.46% for two-year fixed mortgages and 5.23% for five-year terms. Earlier offerings below the 4% “psychological threshold,” important for market perception as noted by Tom Bill, head of UK residential research at Knight Frank, have largely vanished, indicating a shift in the lending landscape.

Bill noted, “We’ve firmly established rates above 4% for both two- and five-year fixed mortgages. While certain demographics are compelled to relocate due to factors like schooling and employment, mortgage rates below 4% tend to stimulate additional discretionary buying, which may be slower to rebound.”

He further anticipated that lenders might reduce their mortgage rates in January to attract more business, suggesting, “You may encounter the occasional sub-4% mortgage rate in the first half of the year, but the widespread availability of rates in the three-percent range, similar to what was seen in late summer, is unlikely to be as prevalent.”

Upcoming changes to stamp duty, effective 1 April, are expected to introduce market volatility, as indicated by property experts. The urgency to close deals before this date to mitigate higher costs due to a revised lower threshold and the introduction of an additional band for second home purchases is likely to drive increased activity in the market from January through March, with an anticipated slowdown in April.

In the rental sector, 2025 is poised to witness a normalisation of private rental growth, with forecasted average rent increases decelerating sharply to 4% or lower. This follows significant hikes of 9.1% across the UK and 9.3% in England over the past year—a record high, according to the ONS.

Chestertons, a real estate agency, has observed an increase in available rental properties, citing growing financial pressures on tenants. With rents consuming nearly 40% of incomes, many tenants are facing challenges in managing additional cost increases, despite wage growth. This financial strain is leading to reduced market entry and more tenants negotiating lower rent prices.

Additionally, the impending Renters’ Rights Bill may prompt some landlords to exit the market, potentially reducing property availability further.