The UK housing market has demonstrated remarkable resilience and growth in 2024, a significant rebound from the previous year’s dip. Here’s a closer look at the dynamics and statistics shaping this vital sector. In a striking turnaround from last year’s deflation of -0.9%, UK house price inflation has climbed to +1%. This shift reflects an increase in market activity, setting a pace reminiscent of the 2020 housing boom. Current sales levels are at their highest since 2020, powered by a blend of favourable economic factors and market dynamics.

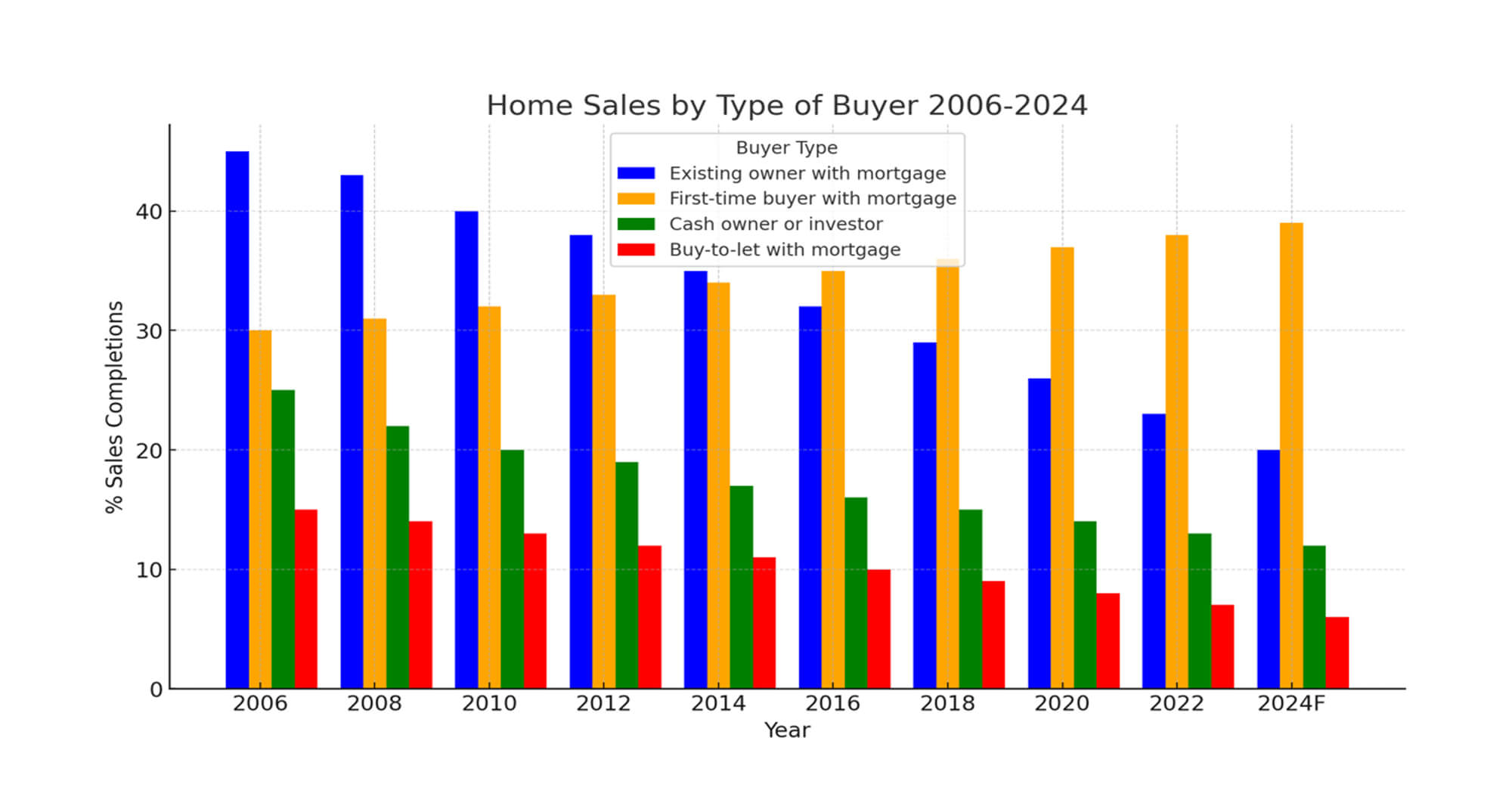

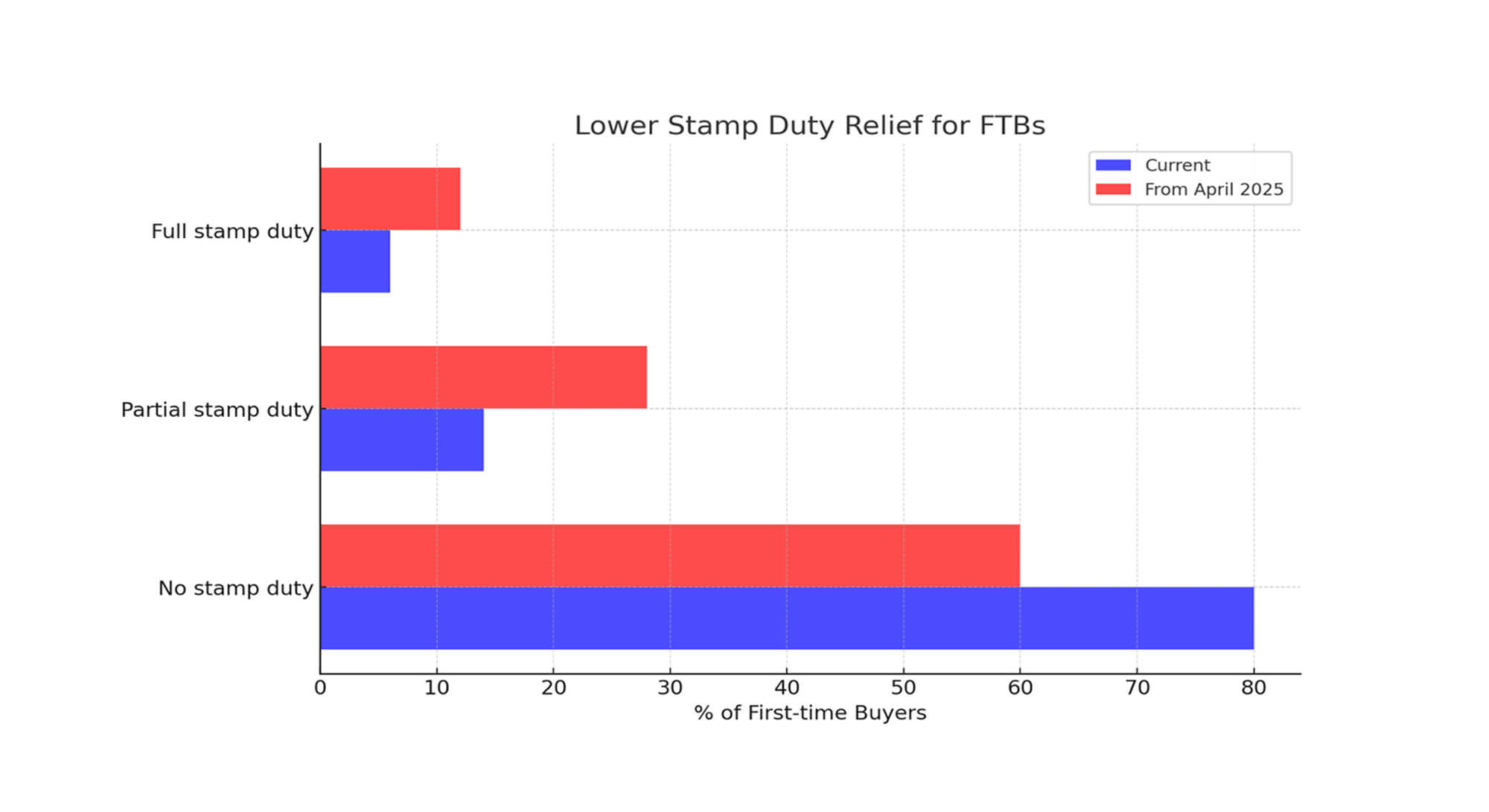

Despite the upward trend in house prices, the growth remains tempered by a robust supply of homes and persistent affordability challenges. These factors are crucial in keeping the inflation in check, preventing the overheating of the market. First-time buyers (FTBs) have emerged as the dominant force in 2024, making up 36% of all property sales. This surge is supported by a significant shift in the renting versus buying dynamics, thanks to decreasing mortgage rates and escalating rents. These changes have made purchasing homes more feasible for FTBs, even as they face potential increases in stamp duty due to government fiscal adjustments.

Escalation in House Price Inflation

In a striking turnaround from last year’s deflation of -0.9%, UK house price inflation has climbed to +1%. This shift reflects an increase in market activity, setting a pace reminiscent of the 2020 housing boom.

Sales Activity Peaks

Current sales levels are at their highest since 2020, powered by a blend of favourable economic factors and market dynamics. The total pipeline of sales agreed has surged by 30% from last year, now valued at a staggering £113 billion.

Market Dynamics

Despite the upward trend in house prices, the growth remains tempered by a robust supply of homes and persistent affordability challenges. These factors are crucial in keeping the inflation in check, preventing the overheating of the market.

First-Time Buyers Take the Lead

First-time buyers (FTBs) have emerged as the dominant force in 2024, making up 36% of all property sales. This surge is supported by a significant shift in the renting versus buying dynamics, thanks to decreasing mortgage rates and escalating rents. These changes have made purchasing homes more feasible for FTBs, even as they face potential increases in stamp duty due to government fiscal adjustments.

Regional Price Variations

House price growth has been uneven across the UK. Regions like the Northeast and Yorkshire & Humberside are seeing prices rise by about 2%, while more affluent areas such as the Southeast experience slight declines. This disparity highlights the varied economic conditions across the country.

Mortgage and Rent Dynamics

The competition among lenders has driven down mortgage rates to their lowest in two years, further fuelling the market. The average mortgage payment for FTBs is now 17% cheaper than renting, a significant shift from just a year ago. This affordability has incentivized more FTBs to enter the market, despite the looming threat of increased stamp duty expenses.

Looking Ahead: Government Policies and Market Projections

The government’s upcoming budget could play a pivotal role in shaping the future trajectory of the housing market. Any reversal in stamp duty relief for FTBs could dampen this burgeoning buyer segment. However, with continued low mortgage rates and a projected modest increase in house prices by 2% by the end of the year, the market outlook remains optimistic.

In summary, 2024 has been a year of robust growth and dynamic changes in the UK housing market, with FTBs leading the charge amidst fluctuating economic policies and market conditions. The resilience of this sector continues to reflect broader economic trends, suggesting a cautious yet hopeful outlook for the future.