Implications of Labour Budget on landlords and second home buyers

The Chancellor, Rachel Reeves, has announced an increase in the Stamp Duty Land Tax surcharge for second home purchases, raising it from 3% to 5%. This change takes effect immediately and is part of her first Budget. The move will significantly impact second home buyers and landlords, who will now face higher Stamp Duty costs. Importantly, the Chancellor has also chosen not to keep the higher Stamp Duty thresholds for primary homebuyers introduced by the previous government.

From April next year, primary homebuyers will lose the higher Stamp Duty thresholds introduced in 2022:

- First-time buyers will pay Stamp Duty on property values above £300,000.

- Second home / BTL purchases will pay Stamp Duty on values over £125,000.

Changes to the Right to Buy Scheme

Housing Secretary Angela Rayner also announced a cut to the maximum cash discounts under the Right to Buy scheme. Discounts for council homes will drop from over £100,000 to £38,000. This change is expected to reduce sales under the scheme by around 25,000 over the next five years.

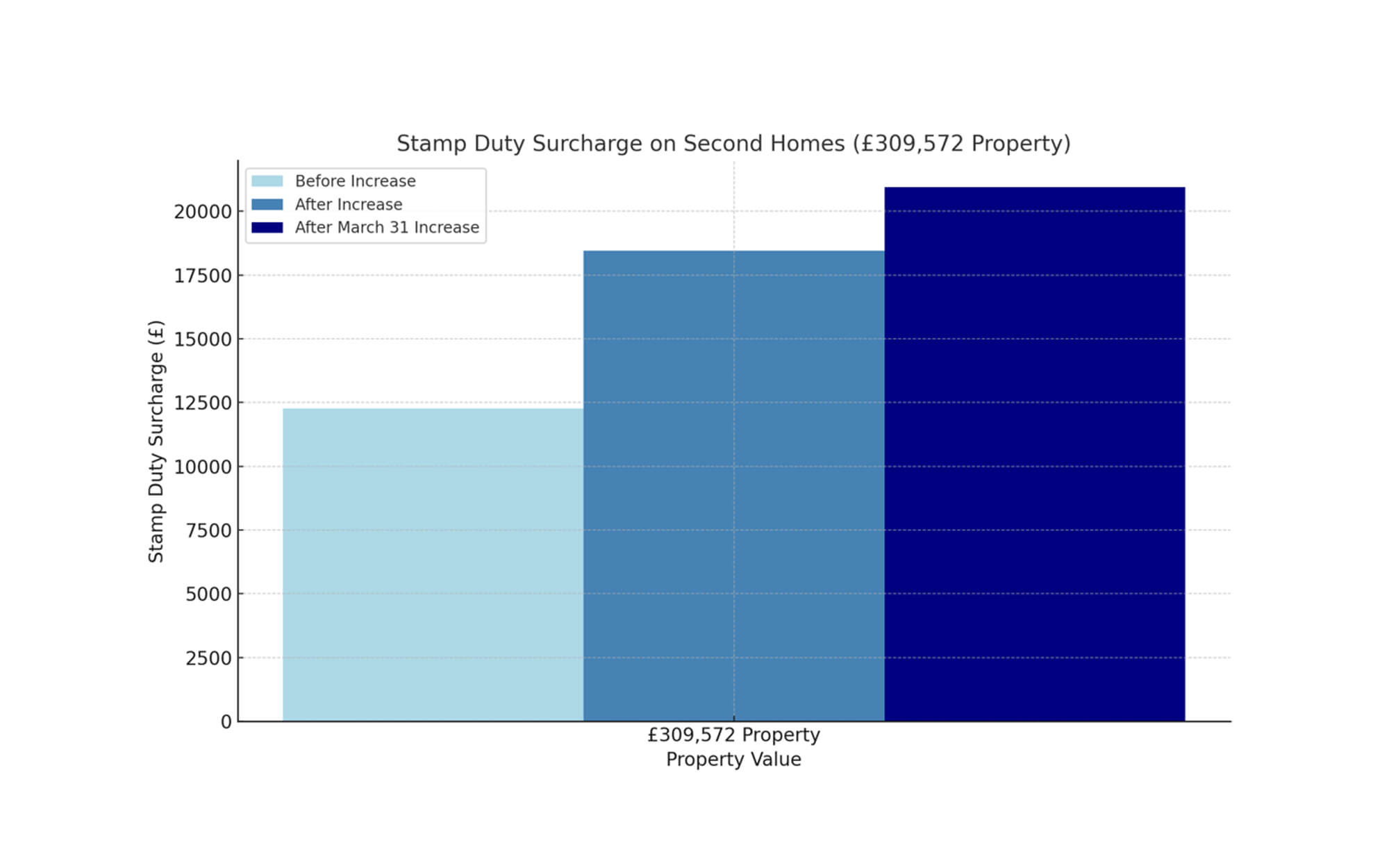

In practical terms, for a second home purchase valued at £309,572, the surcharge will increase from £12,265 to £18,457, representing a 50% rise according to Coventry Building Society’s estimates. This surcharge will escalate further after March 31, reaching £20,957, a 71% increase compared to current rates.

Additionally, Housing Secretary Angela Rayner confirmed a reduction in the Right to Buy scheme’s maximum cash discounts, reducing them from over £100,000 to £38,000 for council homes. This change is expected to result in approximately 25,000 fewer sales under the scheme over the next five years.

Property industry experts have expressed concern regarding these new measures. Angharad Trueman, president of Propertymark, highlighted the strain on the private rental market due to a reduced supply of rental homes amid rising demand. Richard Donnell of Zoopla noted the regional impact, indicating that the changes would most significantly affect buyers in southern England, where London and the Southeast currently account for over 50% of Stamp Duty revenue.

Under the updated Stamp Duty framework, primary homebuyers will soon lose access to the higher thresholds established in 2022. Effective April next year, first-time buyers will begin paying Stamp Duty on property values above £300,000, and home movers on values over £125,000. This shift is expected to bring an additional 20% of first-time buyers into the tax’s scope, as well as increase costs for home movers.

The Treasury projects that increasing Stamp Duty for second homes will generate an additional £310 million by 2030, freeing up around 130,000 properties for first-time buyers and home movers. However, with property transactions already slowing, there are concerns about potential impacts on overall tax revenues and housing market momentum.

Here is a bar graph representing the Stamp Duty surcharge increase on a second home valued at £309,572. It shows the surcharge amounts before the increase, after the increase, and the further rise planned for after March 31.